How to Submit a Tax Request via Zendesk and JIRA

Table of Contents

- Overview

- Objective

- Platforms Involved

- Scope

- Related Resources

- Use Case

- Workflow

- Exhibits / Appendices / Forms / Supporting Documents/Resources

- Change Control Log

Overview

This guide explains how to submit a tax request using our integrated system, which combines Zendesk and JIRA. The process allows for seamless submission and monitoring of tax-related issues.

Objective

The primary goal is to ensure efficient submission and tracking of tax requests, enabling quick triage and resolution by the tax team.

Platforms Involved

- Zendesk

- JIRA

Scope

This guide applies to all users needing to submit tax requests and track them through Zendesk and JIRA.

Related Resources

- Internal Zendesk and JIRA manuals

- Tax request channel link (to be shared internally)

Use Case

This guide is used when a user needs to request assistance from the tax team for specific issues encountered in a ticket.

Workflow

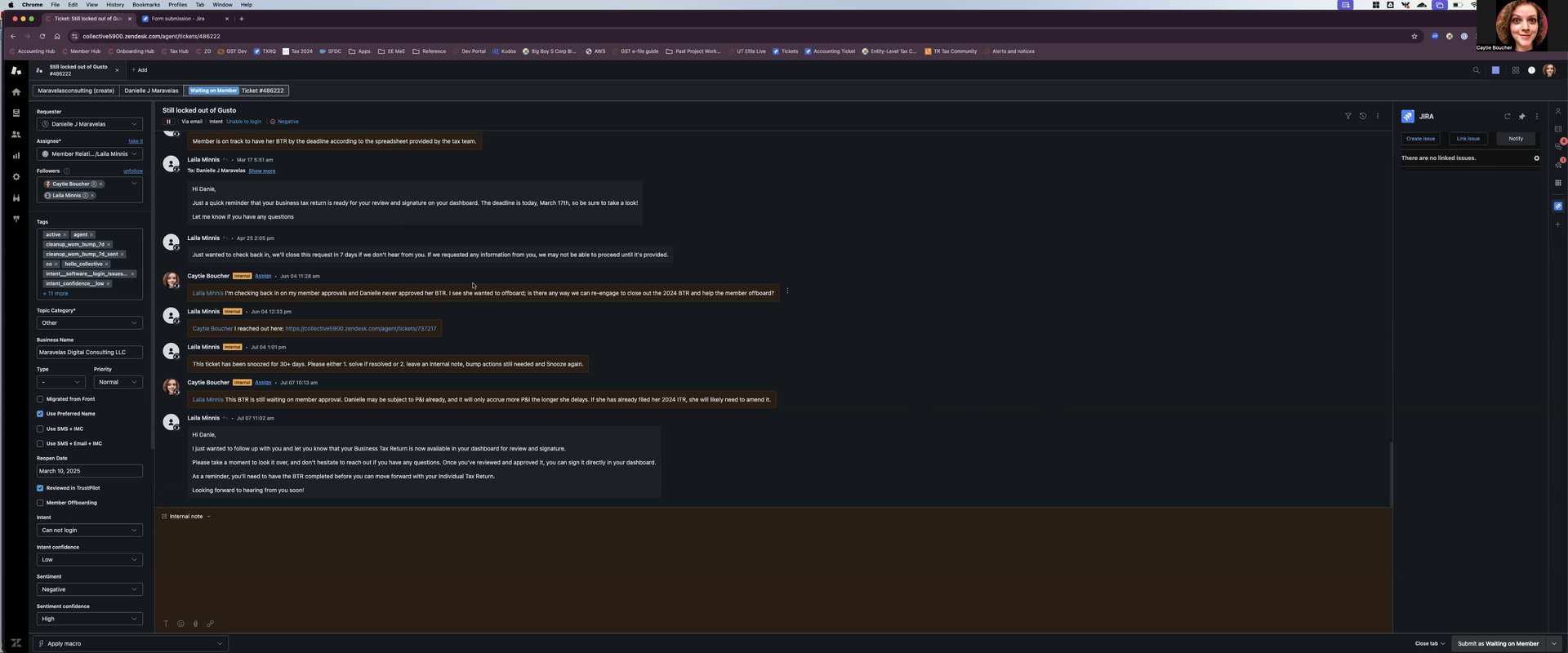

Step 1: Navigate to the Ticket

Locate the ticket in Zendesk where you are encountering the issue and need assistance from the tax team.

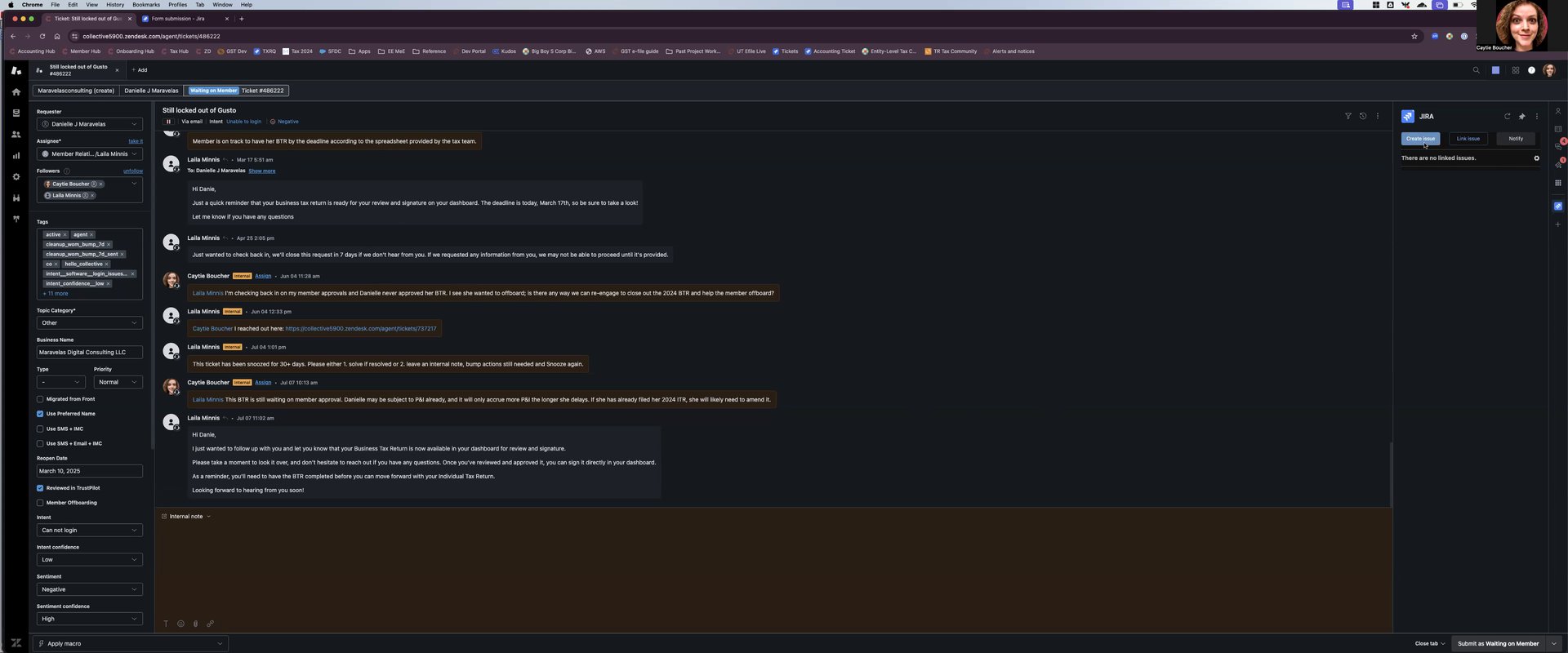

Step 2: Create a New Issue

Click on the option to create a new issue.

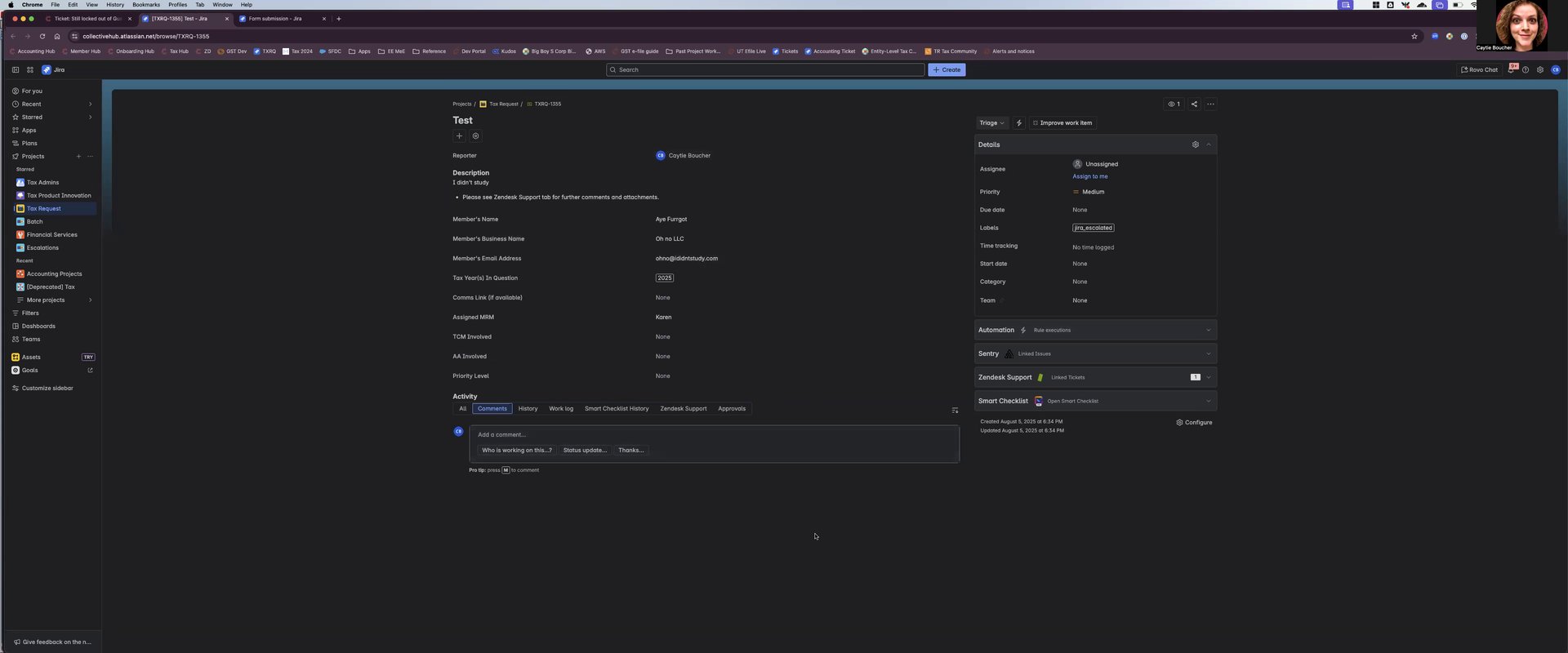

Step 3: Fill in the Required Details

- Type "tax" in the issue type field and select "Tax Request."

- The issue type will automatically set to "Tax Request."

- You will be autofilled as the reporter and added as a watcher.

- Leave the assignee field blank for quick triage.

- Provide a summary, member's business name, email, MRM, tax years involved, priority level, and the member's name.

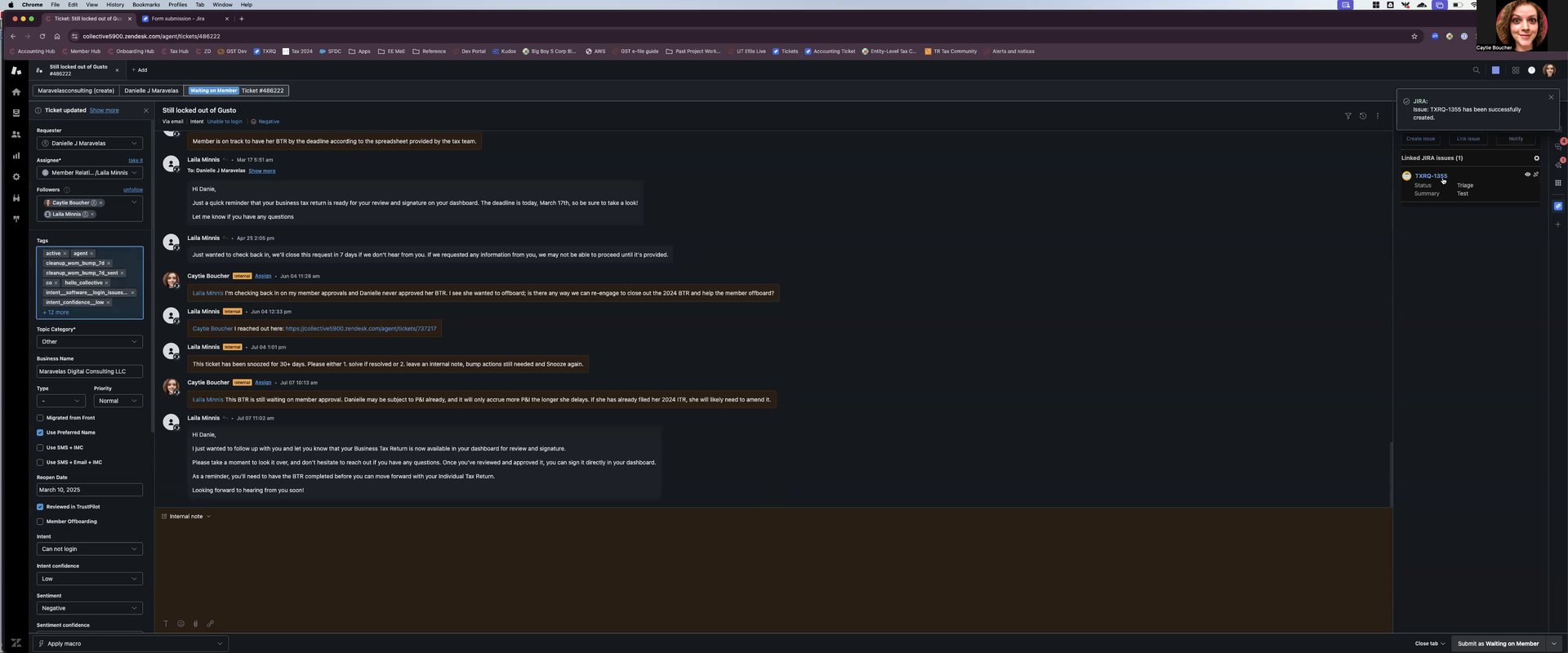

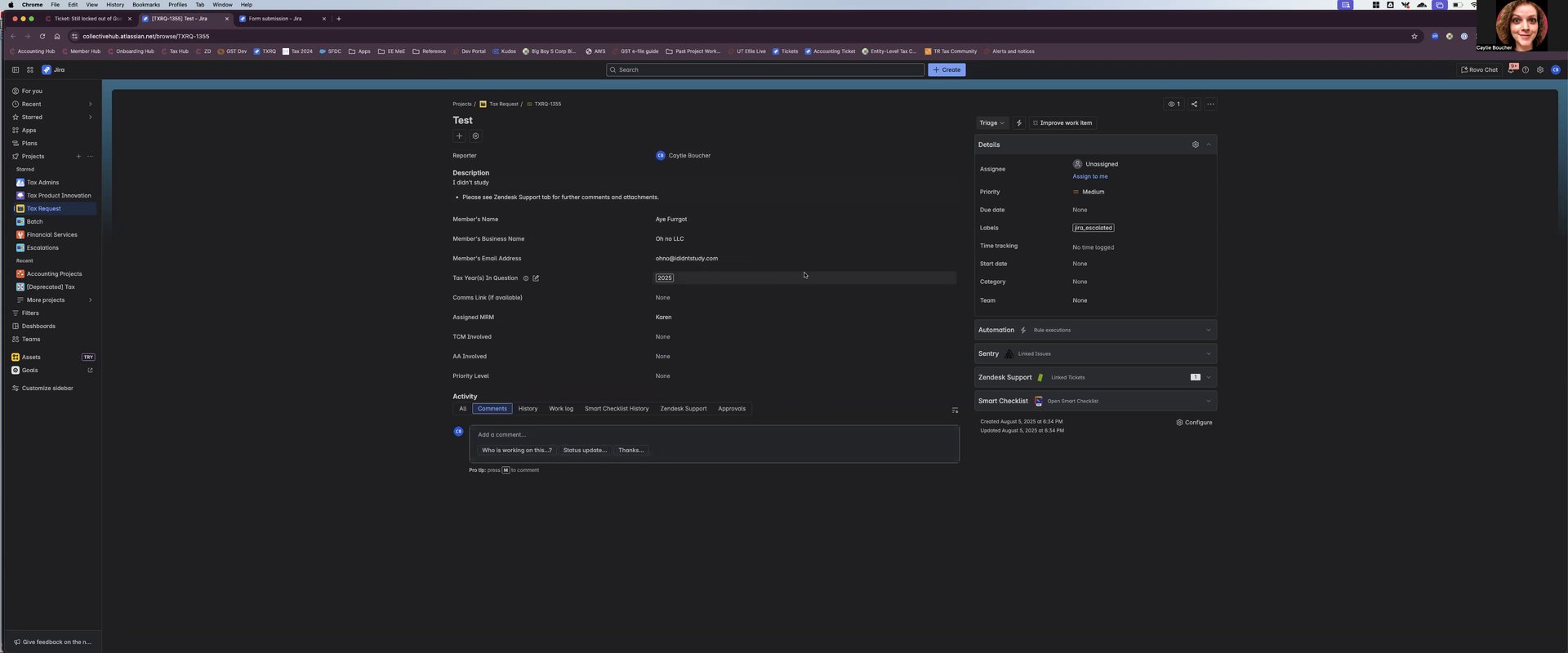

Step 4: Create the Tax Request

Submit the form to create the tax request. You can then access and monitor the ticket.

Step 5: Monitoring and Communication

Monitor the ticket in Zendesk, where the tax team will communicate with you.

Step 6: Backup Submission via JIRA

If Zendesk is down, submit the request directly through JIRA using the form link provided in the tax request channel.

Exhibits / Appendices / Forms / Supporting Documents/Resources

- Link to the JIRA form for backup submissions (shared internally)

Change Control Log

- Initial creation of the guide.

Please let me know if you have any questions. Thank you!